A) bonds instead of money because as the interest rate starts to rise,the value of the bonds will increase.

B) bonds instead of money because the opportunity cost of money is high.

C) money instead of bonds because the brokerage fees and other costs of buying bonds are high when the interest rate is low.

D) money instead of bonds because there is a speculative motive for holding a larger amount of money.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

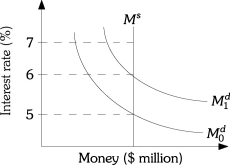

Refer to the information provided in Figure 11.6 below to answer the questions that follow.  Figure 11.6

-Refer to Figure 11.6.If the demand for money curve shifts from

Figure 11.6

-Refer to Figure 11.6.If the demand for money curve shifts from  to

to  ,the equilibrium interest rate will

,the equilibrium interest rate will

A) increase from 5% to 7%.

B) increase from 5% to 10%.

C) decrease from 7% to 5%.

D) remain at 7%.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

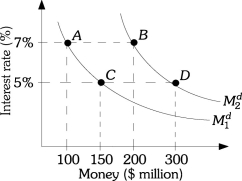

Refer to the information provided in Figure 11.2 below to answer the questions that follow.  Figure 11.2

-Refer to Figure 11.2.Suppose that money demand is currently at Point B.A movement to Point D could be caused by

Figure 11.2

-Refer to Figure 11.2.Suppose that money demand is currently at Point B.A movement to Point D could be caused by

A) an increase in income,ceteris paribus.

B) an increase in the price level,ceteris paribus.

C) a decrease in the price level,ceteris paribus.

D) a decrease in the interest rate,ceteris paribus.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The average monthly balance in Aaron's bank account is $2,000.Aaron spends the same amount of money each day during the month,and at the end of the month his account balance is $0.Aaron's monthly starting balance is

A) $2,000.

B) $3,500.

C) $4,000.

D) $6,000.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

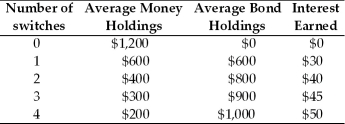

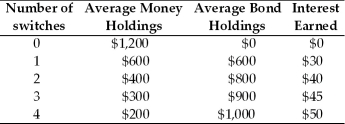

Refer to the information provided in Table 11.1 below to answer the questions that follow.

Table 11.1  -Refer to Table 11.1.If it costs $13 each time a bond is sold,the highest profit available is

-Refer to Table 11.1.If it costs $13 each time a bond is sold,the highest profit available is

A) $6.

B) $13.

C) $17.

D) $21.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When the aggregate price level (P) is multiplied by real aggregate income (Y) ,the result is

A) the aggregate money multiplier.

B) the real aggregate price level.

C) nominal aggregate output.

D) aggregate money demand.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The price of bonds and the interest rate are

A) positively related.

B) negatively related.

C) sometimes positively related and other times negatively related,depending on the bond payments.

D) not related.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

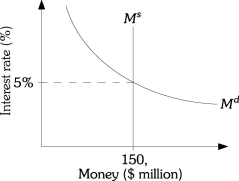

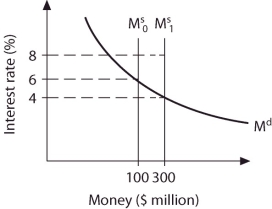

Refer to the information provided in Figure 11.3 below to answer the questions that follow.  Figure 11.3

-Refer to Figure 11.3.At an interest rate of 3%,there is a

Figure 11.3

-Refer to Figure 11.3.At an interest rate of 3%,there is a

A) shortage of money and the interest rate will decline.

B) shortage of money and the interest rate will rise.

C) surplus of money and the interest rate will decline.

D) surplus of money and the interest rate will rise.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

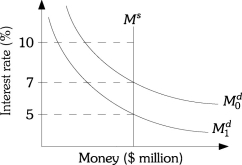

Refer to the information provided in Figure 11.5 below to answer the questions that follow.  Figure 11.5

-Refer to Figure 11.5.The money supply curve will shift from

Figure 11.5

-Refer to Figure 11.5.The money supply curve will shift from  to

to  ,if

,if

A) the Fed increases the discount rate.

B) the price level increases.

C) the equilibrium level of output decreases.

D) the Fed buys U.S.government securities in the open market.

Correct Answer

verified

Correct Answer

verified

True/False

Federal funds rate is the tax rate on income.

Correct Answer

verified

Correct Answer

verified

True/False

The market-determined prices of existing bonds and interest rates are directly related.

Correct Answer

verified

Correct Answer

verified

True/False

The optimal money balance will increase as the interest rate rises,ceteris paribus.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The interest rate that banks are charged when they borrow reserves from other banks is the

A) federal funds rate.

B) AAA corporate bond rate.

C) commercial paper rate.

D) prime rate.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

An increase in nominal aggregate output,ceteris paribus,will cause the demand for money to ________ and the interest rate to ________.

A) increase;increase

B) increase;decrease

C) decrease;decrease

D) decrease;increase

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following events will lead to a decrease in the equilibrium interest rate?

A) an increase in the level of nominal aggregate output

B) a decrease in the required reserve ratio

C) an increase in the price level

D) a sale of government securities by the Federal Reserve

Correct Answer

verified

Correct Answer

verified

True/False

If people think interest rates are above their normal levels,they will want to hold bonds in anticipation of a capital gain when interest rates fall to their normal level.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Refer to the information provided in Figure 11.7 below to answer the questions that follow.  Figure 11.7

-Refer to Figure 11.7.If the demand for money curve shifts from

Figure 11.7

-Refer to Figure 11.7.If the demand for money curve shifts from  to

to  ,the equilibrium interest rate will

,the equilibrium interest rate will

A) decrease from 7% to 5%.

B) increase from 5% to 7%.

C) increase from 5% to 6%.

D) remain at 5%.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The rate that the Fed controls most closely through its open-market operations is the

A) prime rate.

B) federal funds rate.

C) commercial paper rate.

D) government bonds rate.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Refer to the information provided in Table 11.1 below to answer the questions that follow.

Table 11.1  -Refer to Table 11.1.If the period covered by Table 11.1 is one year,the interest rate paid on bonds

-Refer to Table 11.1.If the period covered by Table 11.1 is one year,the interest rate paid on bonds

A) is 2%.

B) is 3%.

C) is 5%.

D) cannot be determined from this information.

Correct Answer

verified

Correct Answer

verified

True/False

To increase the money supply and decrease interest rates,the Fed could purchase government securities.

Correct Answer

verified

Correct Answer

verified

Showing 21 - 40 of 129

Related Exams