A) cash flow problem.

B) financial float.

C) money management problem.

D) nonsynchronization of income and spending.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Federal funds are

A) interbank loans.

B) raised by taxes.

C) loans that banks get from the Fed.

D) bonds issued by the federal government.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

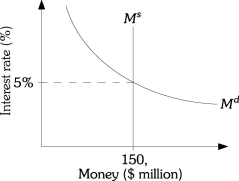

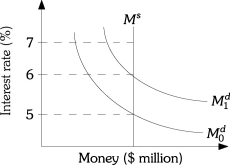

Refer to the information provided in Figure 11.3 below to answer the questions that follow.  Figure 11.3

-Refer to Figure 11.3.A decrease in the money supply and an increase in nominal aggregate output will,for sure,

Figure 11.3

-Refer to Figure 11.3.A decrease in the money supply and an increase in nominal aggregate output will,for sure,

A) increase the equilibrium interest rate.

B) decrease the equilibrium interest rate.

C) increase equilibrium money holdings.

D) decrease equilibrium money holdings.

Correct Answer

verified

Correct Answer

verified

True/False

A decrease in nominal aggregate output will lead to an increase in the interest rate.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

As the number of transactions in the economy decreases,

A) the supply of money increases.

B) the supply of money decreases.

C) the demand for money increases.

D) the demand for money decreases.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Ed's monthly starting balance is $3,000.Ed spends $100 per day.Initially,Ed keeps all of his income in a non-interest-bearing checking account.Ed decided to change his strategy and at the beginning of each month he deposits one-third of his income into his checking account and buys two bonds with the remainder of his income.After 10 days he cashes in one bond and 10 days after that he cashes in the other bond.Which of the following statements is TRUE?

A) If Ed uses either strategy,his average monthly balance is $1,500.

B) The second strategy involves lower money management costs because Ed now earns interest on the bonds he has purchased.

C) Ed's optimal money balance is $100.

D) If the interest rate paid on bonds decreases,the opportunity cost of Ed's original strategy is reduced.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The transaction demand for money depends on all of the following EXCEPT

A) income.

B) the price level.

C) the interest rate.

D) the amount of transactions spending.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

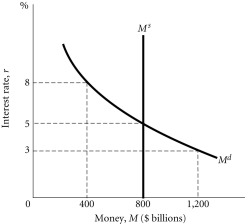

Refer to the information provided in Figure 11.4 below to answer the questions that follow.  Figure 11.4

-Refer to Figure 11.4.At an interest rate of 3%,there is

Figure 11.4

-Refer to Figure 11.4.At an interest rate of 3%,there is

A) an excess supply of money of $400 billion.

B) an excess supply of money of $800 billion.

C) an excess demand for money of $800 billion.

D) an excess demand for money of $400 billion.

Correct Answer

verified

Correct Answer

verified

True/False

Commercial paper is a short term IOU of a corporation.

Correct Answer

verified

Correct Answer

verified

True/False

When interest rates fall,bond values rise.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The speculative demand for money

A) increases when income increases above normal.

B) decreases when interest rates decrease below normal.

C) increases when interest rates decrease below normal.

D) decreases when the price level decreases below normal.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

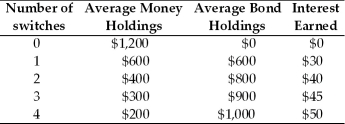

Refer to the information provided in Table 11.1 below to answer the questions that follow.

Table 11.1  -Refer to Table 11.1.At a price of ________ the optimal number of switches is ________.

-Refer to Table 11.1.At a price of ________ the optimal number of switches is ________.

A) $7;1

B) $9;3

C) $11;1

D) $13;0

Correct Answer

verified

Correct Answer

verified

True/False

If the Federal Reserve lowers the required reserve ratio,then the money supply will fall.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Government securities with terms of more than one year are called

A) Treasury bills.

B) federal funds bonds.

C) capital bills.

D) government bonds.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

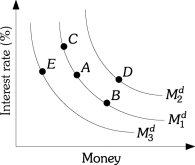

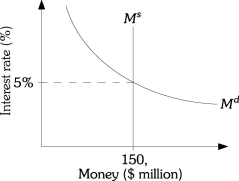

Refer to the information provided in Figure 11.1 below to answer the questions that follow.  Figure 11.1

-Refer to Figure 11.1.A movement from Point D to Point A can be caused by

Figure 11.1

-Refer to Figure 11.1.A movement from Point D to Point A can be caused by

A) a decrease in the interest rate.

B) an increase in income.

C) a decrease in nominal aggregate output.

D) an increase in the interest rate.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

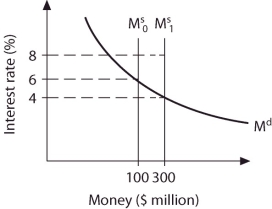

Refer to the information provided in Figure 11.7 below to answer the questions that follow.  Figure 11.7

-Refer to Figure 11.7.The demand for money curve will shift from

Figure 11.7

-Refer to Figure 11.7.The demand for money curve will shift from  to

to  if

if

A) the Fed sells government securities on the open market.

B) the price level decreases.

C) the interest rate increases.

D) the level of nominal aggregate output increases.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Refer to the information provided in Figure 11.3 below to answer the questions that follow.  Figure 11.3

-Refer to Figure 11.3.At an interest rate of 6%,there is a

Figure 11.3

-Refer to Figure 11.3.At an interest rate of 6%,there is a

A) shortage of money and the interest rate will decline.

B) shortage of money and the interest rate will rise.

C) surplus of money and the interest rate will decline.

D) surplus of money and the interest rate will rise.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Refer to the information provided in Figure 11.5 below to answer the questions that follow.  Figure 11.5

-Refer to Figure 11.5.The money supply curve will shift from

Figure 11.5

-Refer to Figure 11.5.The money supply curve will shift from  to

to  if

if

A) the Fed increases the reserve requirement.

B) the Fed increases the discount rate.

C) the equilibrium level of output increases.

D) the Fed buys U.S.government securities in the open market.

Correct Answer

verified

Correct Answer

verified

True/False

Less switching from bonds to money means less interest revenue lost,but higher money management costs.

Correct Answer

verified

Correct Answer

verified

True/False

Investors may wish to hold bonds when interest rates are low with the hope of selling them when interest rates increase.

Correct Answer

verified

Correct Answer

verified

Showing 101 - 120 of 129

Related Exams