A) retained earnings to be understated on the 2014 balance sheet.

B) 2015 balance sheet not to be misstated

C) cost of goods sold to be overstated on the 2014 income statement.

D) cost of goods sold to be understated on the 2015 income statement.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When a firm changed its method of accounting for inventory from LIFO to FIFO in 2014,it decided that the 2014 financial statements should be shown comparatively with the 2013 results. Which of the following statements concerning reporting the change in the retained earnings statement is correct?

A) Both the January 1,2013,and January 1,2014,retained earnings balances are reported at different amounts to reflect the effects of the change in earnings before those respective dates.

B) Only the January 1,2013,retained earnings balance is reported at a different amount to reflect the effects of the change in earnings.

C) Only the January 1,2014,retained earnings balance is reported at a different amount to reflect the effects of the change in earnings.

D) No direct change to retained earnings is needed since earnings for both years have been adjusted to reflect the change.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is NOT a change in reporting entity?

A) A company acquires a subsidiary that is to be accounted for as a purchase.

B) A company presents consolidated or combined statements in place of statements of individual companies.

C) A company changes the companies included in combined financial statements.

D) A company changes the subsidiaries for which consolidated statements are presented.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In 2014,a company changed from the LIFO method of accounting for inventory to FIFO.The company's 2013 and 2014 comparative financial statements will reflect which method or methods? 2013 2014

A) LIFO LIFO

B) FIFO FIFO

C) LIFO FIFO

D) LIFO either LIFO or FIFO

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following should NOT be reported retroactively?

A) Use of an unacceptable accounting principle,then changing to an acceptable accounting principle

B) Correction of an overstatement of ending inventory made two years ago

C) Use of an unrealistic accounting estimate,then changing to a realistic estimate

D) Change from a good faith but erroneous estimate to a new estimate

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is not correct regarding the provisions of IAS No.8 on accounting changes and error corrections?

A) IAS No.8 requires that results from prior periods be presented for all changes in accounting principles.

B) IAS No.8 allows a change in accounting principle to be accounted for by reflecting the cumulative effect of the change in the income of the current period without restating prior-period results.

C) Under IAS No.8,the recommended approach for a change in accounting principle is that results from prior periods should be restated.

D) IAS No.8 requires a change in accounting estimate to be reflected in the current and future periods.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The cumulative effect on prior years' earnings of a change in accounting principle should be reported separately as an adjustment to retained earnings for the earliest period presented for all of the following changes except

A) completed-contract method of accounting for long-term construction-type contracts to the percentage-of-completion method.

B) percentage-of-completion method of accounting for long-term construction-type contracts to the completed-contract method.

C) FIFO method of inventory pricing to LIFO method.

D) LIFO method of inventory pricing to the weighted-average method.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Ending inventory for 2012 is overstated by $5,500 due to a faulty count and costing.The tax rate is 39%.Assume the same accounting methods for both financial reporting and taxes.The error is discovered late in 2014.The 2014 annual report shows the financial statements for 2012,2013,2014 on a comparative basis. Which of the following is correct regarding the reporting of this error in the 2014 annual report?

A) A journal entry is made to report the prior period adjustment,and the 2012 and 2013 statements are shown corrected.

B) No journal entry is needed,and the 2012 and 2013 statements are shown as they were in the 2013 annual report.

C) No journal entry is needed,and the 2012 and 2013 statements are shown corrected.

D) A journal entry is made to report the prior period adjustment,and the 2012 and 2013 statements are shown as they were in the 2013 annual report.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is not an example of an accounting error,as distinguished from a change in accounting principle or change in accounting estimate?

A) Misstatement of assets,liabilities,or owners' equity

B) Incorrect classification of an expenditure as between expense and an asset

C) Failure to recognize accruals and deferrals

D) Recognition of a gain on disposal of fully depreciated property

Correct Answer

verified

Correct Answer

verified

Multiple Choice

On January 1,2011,Caravanos Company purchased for $320,000 a machine with a useful life of ten years and no salvage value.The machine was depreciated by the double-declining-balance method,and the carrying amount of the machine was $204,800 on December 31,2012.Caravanos changed to the straight-line method on January 1,2013.Caravanos can justify the change.What should be the depreciation expense on this machine for the year ended December 31,2014?

A) $20,480

B) 25,600

C) 32,000

D) 52,480

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following,if discovered by Somber Company in the accounting period subsequent to the period of occurrence,requires the company to report the correction of an error?

A) The estimate of the useful life of a depreciable asset should have been revised.

B) Capitalization of an expense

C) A change from declining-balance depreciation method to straight-line method

D) Change in percentage of sales used for determining bad debt expense

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Queener Corporation uses a periodic inventory system and neglected to record a purchase of merchandise on account at year-end.This merchandise was omitted from the year-end physical count.How will these errors affect Queener's assets,liabilities,and stockholders' equity at year-end and net earnings for the year? Stockholders' Assets Liabilities Equity Net Earnings

A) Understate Understate No effect No effect

B) Understate No effect Understate Understate

C) No effect Understate Overstate Overstate

D) No effect Overstate Understate Understate

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Albritton Inc.bought a patent for $900,000 on January 2,2010,at which time the patent had an estimated useful life of ten years.On February 2,2014,it was determined that the patent's useful life would expire at the end of 2016.How much would Albritton record as amortization expense for this patent for the year ending December 31,2014?

A) $200,000

B) $180,000

C) $110,000

D) $90,000

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is characteristic of a change in accounting estimate?

A) Requires the reporting of pro forma amounts for prior periods

B) Does not affect the financial statements of prior periods

C) Never needs to be disclosed

D) Should be reported by retrospectively adjusting the financial statements for all years reported,and reporting the cumulative effect of the change in income for all preceding years as an adjustment to the beginning balance of retained earnings for the earliest year reported

Correct Answer

verified

Correct Answer

verified

Multiple Choice

For a company with a periodic inventory system,which of the following would cause income to be overstated in the period of occurrence?

A) Overestimating bad debt expense

B) Understating beginning inventory

C) Overstated purchases

D) Understated ending inventory

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The effect of a change in accounting principle that is inseparable from the effect of a change in accounting estimate should be reported

A) by showing the pro forma effects of retroactive application.

B) by restating the financial statements of all prior periods presented.

C) in the period of change and future periods

D) as a correction of an error.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

On January 2,2012,Lynch Company acquired machinery at a cost of $800,000.This machinery was being depreciated by the double-declining-balance method over an estimated useful life of eight years,with no residual value.At the beginning of 2014,Lynch decided to change to the straight-line method of depreciation.Ignoring income tax considerations,the cumulative effect of this accounting change is

A) $0.

B) $100,000.

C) $155,556

D) $177,778

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is characteristic of a change in accounting principle?

A) Requires the reporting of pro forma amounts for prior periods

B) Does not affect the financial statements of prior periods

C) Never needs to be disclosed

D) Should be reported by retrospectively adjusting the financial statements for all years reported,and reporting the cumulative effect of the change in income for all preceding years as an adjustment to the beginning balance of retained earnings for the earliest year reported

Correct Answer

verified

Correct Answer

verified

Multiple Choice

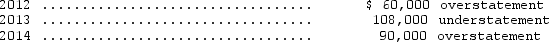

Newsman Co.made the following errors in counting its year-end physical inventories:  As a result of the above undetected errors,2014 income was

As a result of the above undetected errors,2014 income was

A) understated by $18,000.

B) overstated by $198,000.

C) overstated by $18,000.

D) understated by $198,000.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Asuncion Company purchased some equipment on January 2,2011,for $24,000.The company used straight-line depreciation based on a ten-year estimated life with no residual value.During 2014,management decided that this equipment could be used only three more years and then would be replaced with a technologically superior model.What entry should the company make as of January 1,2014,to reflect this change?

A) No entry

B) Debit a Prior Period Adjustment account for $4,800 and credit accumulated depreciation for $4,800.

C) Debit Retained Earnings for $4,800 and credit accumulated depreciation for $4,800.

D) Debit Depreciation Expense for $4,800 and credit Accumulated Depreciation for $4,800.

Correct Answer

verified

Correct Answer

verified

Showing 21 - 40 of 77

Related Exams