A) average stockholders' equity.

B) total assets.

C) average total assets.

D) net sales.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

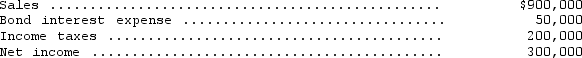

The following data were abstracted from the records of Ballistic Corporation for the year:  How many times was bond interest earned?

How many times was bond interest earned?

A) 18.0

B) 15.0

C) 11.0

D) 10.0

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is not a component of the DuPont Framework?

A) Return on sales

B) Asset turnover

C) Assets to debt

D) Assets to equity

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is included in the calculation of the acid-test (quick) ratio? Accounts Receivable Inventories

A) No No

B) No Yes

C) Yes No

D) Yes Yes

Correct Answer

verified

Correct Answer

verified

Essay

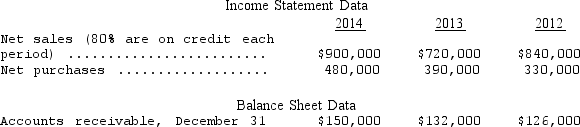

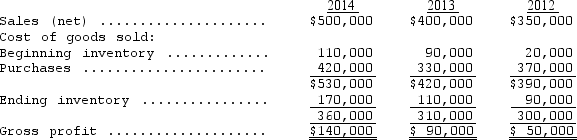

The following are comparative data for Jobs Company for the three-year period 2012-2014:

Compute the following measurements for 2014 and 2013:

Compute the following measurements for 2014 and 2013:

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following ratios measures short-term solvency?

A) Current ratio

B) Creditors' equity to total assets

C) Return on investment

D) Total asset turnover

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following transactions would increase a firm's current ratio?

A) Purchase of inventory on account

B) Payment of accounts payable

C) Collection of accounts receivable

D) Purchase of temporary investments for cash

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If a firm changes its inventory method from FIFO to LIFO just prior to a period of rising prices,the effect in the next period will be Current Ratio Inventory Turnover

A) No effect Increase

B) No effect Decrease

C) Increase Decrease

D) Decrease Increase

Correct Answer

verified

Correct Answer

verified

Multiple Choice

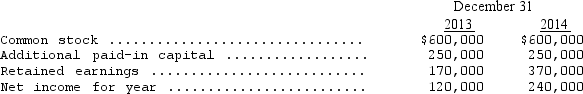

Selected information for Henriot Company is as follows:  Henriot's return on common stockholder's equity,rounded to the nearest percentage point,for 2014 is

Henriot's return on common stockholder's equity,rounded to the nearest percentage point,for 2014 is

A) 20 percent.

B) 21 percent.

C) 28 percent.

D) 40 percent.

Correct Answer

verified

B

Correct Answer

verified

Multiple Choice

Harvest Corporation's capital stock at December 31 consisted of the following: (a) Common stock,$2 par value;100,000 shares authorized,issued,and outstanding.(b) 10% noncumulative,nonconvertible preferred stock,$100 par value;1,000 shares authorized,issued,and outstanding. Harvest's common stock,which is listed on a major stock exchange,was quoted at $4 per share on December 31.Harvest's net income for the year ended December 31 was $50,000.The yearly preferred dividend was declared.No capital stock transactions occurred.What was the price- earnings ratio on Harvest's common stock at December 31?

A) 6 to 1

B) 8 to 1

C) 10 to 1

D) 16 to 1

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is true regarding the debt to equity ratio?

A) The debt to equity ratio is a stringent measure of liquidity.

B) The debt to equity ratio measures the productivity and desirability of the equity investment.

C) The debt to equity ratio measures management's ability to productively employ all its resources.

D) The debt to equity ratio measures the capital structure of the entity.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

How would the quick ratio be affected by a prepayment of $30,000 for fire and liability insurance?

A) The quick ratio would decrease.

B) The quick ratio would increase.

C) The quick ratio would not change.

D) The effect cannot be determined from the information given.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Ringer Corporation had a current ratio of 3.1 at the end of 2013.Current assets and current liabilities increased by equal amounts during 2014.The effects on net working capital and on the current ratio,respectively,were

A) no effect;increase.

B) no effect;decrease.

C) increase;increase.

D) decrease;decrease.

Correct Answer

verified

Correct Answer

verified

Essay

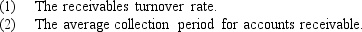

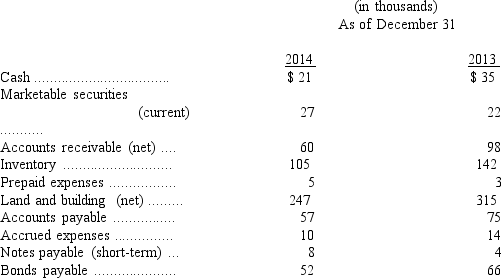

Income statements for Maroon Co.show the following:

From the data presented,calculate the following ratios for 2014 and 2013:

From the data presented,calculate the following ratios for 2014 and 2013:

Correct Answer

verified

11eaafb9_2969_c716_892c_b1620eda6ac9_TB2121_00

Correct Answer

verified

Multiple Choice

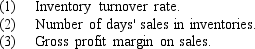

Selected information from the 2014 and 2013 financial statements of Sculley Corporation is presented below:

-Refer to the Sculley Corporation information above.Sculley's current ratio as of December 31,2014,is

-Refer to the Sculley Corporation information above.Sculley's current ratio as of December 31,2014,is

A) 2.84 to 1.

B) 3.37 to 1.

C) 2.91 to 1.

D) 3.33 to 1.

Correct Answer

verified

C

Correct Answer

verified

Multiple Choice

What is the effect of the collection of accounts receivable on the current ratio and net working capital,respectively? Current Ratio Net Working Capital

A) No effect No effect

B) Increase Increase

C) Increase No effect

D) No effect Increase

Correct Answer

verified

Correct Answer

verified

Multiple Choice

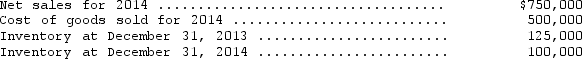

Selected information from the accounting records of Thackary Company is as follows:  Thackary's inventory turnover for 2014 is

Thackary's inventory turnover for 2014 is

A) 7.50 times.

B) 6.665 times.

C) 4.44times.

D) 2.22 times.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following ratios does NOT measure efficiency or activity of an entity?

A) Accounts receivable turnover

B) Age of accounts receivable

C) Net cash flow to current liabilities

D) Times interest earned

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following ratios would NOT be positively affected by a change from LIFO to FIFO,assuming that prices are rising?

A) Current ratio

B) Debt to equity ratio

C) Times interest earned

D) Quick ratio

Correct Answer

verified

Correct Answer

verified

Multiple Choice

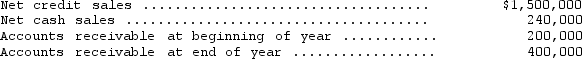

Brookville Corporation's books disclosed the following information for the year ended December 31,2014:  Brookville's accounts receivable turnover is

Brookville's accounts receivable turnover is

A) 3.75 times.

B) 4.35 times.

C) 5.00 times.

D) 5.80 times.

Correct Answer

verified

Correct Answer

verified

Showing 1 - 20 of 50

Related Exams