A) increase income taxes.

B) decrease income taxes.

C) decrease government spending.

D) increase corporate income taxes.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

An example of an automatic stabilizer is:

A) increased unemployment rates cause the government to pay out more in unemployment insurance.

B) increased tax revenues due to nominalincome going up during a boom.

C) reduced unemployment rates during a boom means more people working, and the government pays less out in food assistance.

D) All of these are examples of automatic stabilizers.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

An indirect cost of government debt is:

A) it can distort the credit market and slow economic growth.

B) it can cause hyperinflation.

C) it can cause unemployment below the natural rate.

D) All of these are true.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

By 2016, the dollar value of the debt had climbed:

A) to 104 percent of GDP.

B) to just under $500 billion.

C) to $800 billion.

D) down to 80 percent of GDP.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When an economy is in a recession, discretionary fiscal policy would call for ________, and the automatic stabilizers would ____________.

A) lowering tax rates; lower tax revenues

B) increasing tax rates; increase tax revenues

C) increasing tax revenues; increase tax rates

D) increasing tax rates, lower tax revenues.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Democrats often argue in favor of what to push the economy toward economic recovery, as they did during the recession that began in 2008?

A) Tax cuts

B) Increase government spending

C) Decrease government spending

D) Encourage the public to save more

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If Ricardian equivalence holds, one way to get the expansionary effects of a tax cut to occur is:

A) pair it with reduced government spending.

B) pair it with increased government spending.

C) to run a campaign inspiring people to buy goods made in the United States.

D) None of these will create the expansionary effects of a tax cut.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the government undertakes expansionary fiscal policy, it:

A) could increase income taxes.

B) expects aggregate demand to increase.

C) expects aggregate demand to decrease.

D) should force people to change their spending patterns.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Transfer payments:

A) are payments from government accounts to individuals for programs that do not involve a purchase of goods or services.

B) involve programs such as Social Security and welfare.

C) do not show up in GDP.

D) All of these are true.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The effect of an initial spending change causing a larger change in overall output is:

A) the multiplier effect

B) crowding out.

C) the income effect.

D) the substitution effect.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Two main reasons that the deficit may increase are:

A) decreases in tax revenues and an increase in government spending.

B) changes in interest rates and unemployment.

C) increases in household spending and decreases in firm spending.

D) decreases in tax revenues and government spending.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

According to the text, The American Recovery and Reinvestment Act of 2009:

A) was successful.

B) was unsuccessful.

C) remains hotly debated whether it was successful or not.

D) is known as the most effective legislation ever passed in U.S. history.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

An example of fiscal policy would be government:

A) increasing the amount of available educational grants.

B) decreasing the income tax.

C) increasing corporate income taxes.

D) increasing money supply.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The amount of time it takes for fiscal policy to have an impact on the economy creates:

A) an information lag.

B) a formulation lag.

C) an implementation lag.

D) a direction lag.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the government enacts contractionary fiscal policy, it:

A) must want to slow economic activity.

B) could increase taxes.

C) expects aggregate demand to decrease.

D) All of these are true.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Government decreasing taxes is an example of:

A) expansionary fiscal policy.

B) contractionary fiscal policy.

C) expansionary monetary policy.

D) contractionary monetary policy.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

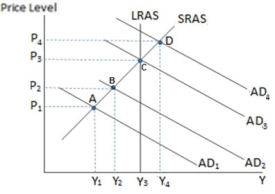

Assuming the economy in the graph shown is currently at equilibrium A, if the government wanted to enact a policy it would likely enact:

Assuming the economy in the graph shown is currently at equilibrium A, if the government wanted to enact a policy it would likely enact:

A) expansionary fiscal policy in an effort to move aggregate demand to the right.

B) contractionary fiscal policy in an effort to move aggregate demand to the left.

C) expansionary fiscal policy in an effort to move aggregate demand to the left.

D) contractionary fiscal policy in an effort to move aggregate demand to the right.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Taxes and government spending that affect fiscal policy without specific action from policymakers are called:

A) automatic stabilizers.

B) discretionary fiscal policy.

C) expansionary fiscal policy.

D) contractionary fiscal policy.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is not true about The American Recovery and Reinvestment Act of 2009:

A) it is more commonly known as the "stimulus plan."

B) it Increased government spending.

C) it included tax cuts.

D) It privatized social security system.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Automatic stabilizers are the:

A) taxes and government spending that affect fiscal policy without specific action from policymakers.

B) fiscal policies that government actively chooses to adopt.

C) expansionary fiscal policies.

D) Keynesian policies.

Correct Answer

verified

Correct Answer

verified

Showing 81 - 100 of 115

Related Exams