A) sales revenue per unit and fixed cost per unit.

B) sales revenue per unit and variable cost per unit.

C) sales revenue per unit and product cost per unit.

D) fixed cost per unit and variable cost per unit.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The break-even point in sales dollars can be calculated by dividing

A) fixed expenses by the unit contribution margin.

B) variable expenses by the unit contribution margin.

C) fixed expenses by the contribution margin ratio.

D) variable expenses by the contribution margin ratio.

Correct Answer

verified

Correct Answer

verified

True/False

When calculating a breakeven point with activity-based costing, all costs from unit, batch, product and facility levels are used in the formula.

Correct Answer

verified

Correct Answer

verified

True/False

'What-if' analysis allows financial models to be manipulated in terms of changes to assumptions and data, to determine the changes in outputs.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following will increase a company's break-even point?

A) Increasing the contribution margin per unit

B) Increasing the variable cost per unit

C) Reducing the company's total fixed costs

D) Increasing the selling price per unit

Correct Answer

verified

Correct Answer

verified

Multiple Choice

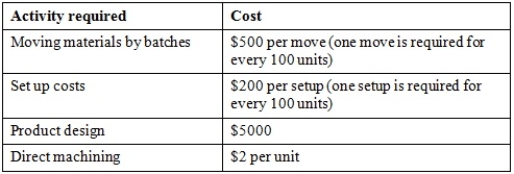

Chelonia Ltd manufactures small robot toys. It plans to introduce a new product, Speedie the robot tortoise. The following activity cost information is available:  It is expected that each unit of Speedie will sell for $23. The direct material cost for unit is $10. What is the break-even point in units?

(For simplicity, assume that you can have partial moves and partial batches - that is, no need to round up the number of batches and the number of moves.)

It is expected that each unit of Speedie will sell for $23. The direct material cost for unit is $10. What is the break-even point in units?

(For simplicity, assume that you can have partial moves and partial batches - that is, no need to round up the number of batches and the number of moves.)

A) 518 units

B) 1000 units

C) 1250 units

D) 2850 units

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Ribco Company Ltd makes and sells only one product. The unit contribution margin is $6, and the break-even point in unit sales is 24 000. What are the company's fixed expenses?

A) $400 000

B) $14 400

C) $40 000

D) $144 000

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Alclear Pool & Spa presently provides a weekly maintenance service to 150 homes. Fixed costs are approximately $13 000 per quarter (13 weeks) . Customers pay $270 per quarter for the weekly service. All contracts are written for one quarter (13 weeks) . Now assume the contracts with customers are restructured such that the price per quarter is $300 and the contribution margin percentage is 57 per cent. Assume the tax rate is 25 per cent. Determine the sales dollars (to the nearest $100) necessary to obtain an after-tax profit of $9600 per quarter.

A) $39 600

B) $45 300

C) $52 900

D) $90 200

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The extent to which an organisation uses fixed costs in its cost structure is called

A) financial leverage.

B) operating leverage.

C) fixed cost leverage.

D) operating leverage AND fixed cost leverage.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Chelonia Ltd manufactures small robot toys. It plans to introduce a new product, Spunkie, which is a solar-powered robot jellyfish. Initially, Chelonia Ltd plans to sell each unit of Spunkie for $95, with an expectation that 2500 units can be sold. The variable cost per unit is $30. The management accountant at Chelonia Ltd is exploring the idea of making some modification to Spunkie which will cost $2 per unit. This modification can allow them to increase the price to $100. This however will lower the demand to 2000 units. Should Chelonia Ltd reduce the price of Spunkie?

A) Yes, as the modified model will increase per unit contribution margin by $3.

B) Yes, as the modified model will increase both the sales revenue and the contribution margin.

C) No, while the modified model will increase the contribution margin per unit, the lower sales volume results in a net decrease in profit.

D) No, while the modified model will increase sales revenue, the lower contribution margin per unit will result in lower overall net profit.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Assume that selling price is greater than variable cost. Now suppose the selling price and the variable cost per unit increase by $5.00. What effect would these changes have on the contribution margin in dollars and on the contribution margin ratio?

A) ![]()

B) ![]()

C) ![]()

D) ![]()

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Would you expect the following to be high or low in an automated firm: (1) level of fixed costs, (2) level of risk and (3) break-even point?

A) High, high, high

B) Low, high low

C) High, high, low

D) Low, low, high

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The break-even point is calculated by

A) sales volume unit selling price / sales volume unit variable cost.

B) variable costs / total revenue.

C) fixed costs / unit contribution margin.

D) variable costs / unit contribution margin.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Under activity-based costing systems, break-even point in units treats which costs as included in the numerator? i. Batch costs ii. Product costs iii. Faculty level costs

A) i and ii

B) i and iii

C) ii and iii

D) All of the given answers

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If break-even sales volume is $40 000 and contribution margin $7500, what is the net profit?

A) $7500

B) $32 500

C) $0

D) Insufficient information to determine

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following are advantages of an activity-based costing approach to cost volume profit (CVP) analysis as compared to a CVP analysis based on traditional product costing?

A) Unit variable costs are recognised more clearly.

B) Fixed costs are viewed as fixed only with respect to changes in sales and production volume, but not as fixed with respect to changes in other cost drivers such as number of set-ups and number of material moves.

C) The assumption in traditional CVP analysis that sales and production volumes are equal can be relaxed.

D) Unit variable costs are recognised more clearly AND fixed costs are viewed as fixed only with respect to changes in sales and production volume, but not with respect to changes in other cost drivers such as number of set-ups and number of material moves.

Correct Answer

verified

Correct Answer

verified

True/False

When interpreting the cost volume profit graph, the break-even point is where the total revenue line intercepts the fixed cost line.

Correct Answer

verified

Correct Answer

verified

True/False

The cost volume profit model is a simple model to use because tax is a factor that does not have to be considered.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Would you expect the following to be high or low in a labour-intensive firm: (1) operating leverage, (2) safety margin and (3) profit potential?

A) Low, high, low

B) Low, low, high

C) High, low, high

D) High, low, low

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is the most precise definition of the operating leverage factor? The operating leverage factor measures

A) the proportion of fixed costs in a firm's cost structure.

B) the proportion of variable costs in a firm's cost structure.

C) the effect that an increase (decrease) in sales volume will have on profit.

D) the proportion of fixed costs in a firm's cost structure AND the proportion of variable costs in a firm's cost structure.

Correct Answer

verified

Correct Answer

verified

Showing 61 - 80 of 111

Related Exams