Asked by

Doneza Alvarez

on Oct 10, 2024

Verified

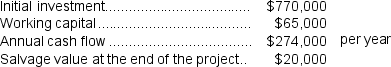

Facio Corporation has provided the following data concerning an investment project that it is considering:  The working capital would be released for use elsewhere at the end of the project in 3 years.The company's discount rate is 8%.The net present value of the project is closest to:

The working capital would be released for use elsewhere at the end of the project in 3 years.The company's discount rate is 8%.The net present value of the project is closest to:

A) $(113,022)

B) $(61,412)

C) $3,588

D) $52,000

Working Capital

An indicator of a company's short-term financial health and operational efficiency, calculated as current assets minus current liabilities.

Discount Rate

The interest rate used in discounted cash flow analysis to determine the present value of future cash flows or to evaluate the attractiveness of an investment.

Net Present Value

A valuation method that calculates the present value of an investment's expected cash flows, minus the initial investment cost.

- Embrace the understanding and formula application of Net Present Value (NPV) and its vital significance in the decision-making process of capital budgeting.

- Investigate and interpret the impact of salvage value on investment decision-making processes.

- Become aware of the impact that discount rates exert on the financial evaluation indicators, NPV and IRR, of projects.

Verified Answer

SR

Learning Objectives

- Embrace the understanding and formula application of Net Present Value (NPV) and its vital significance in the decision-making process of capital budgeting.

- Investigate and interpret the impact of salvage value on investment decision-making processes.

- Become aware of the impact that discount rates exert on the financial evaluation indicators, NPV and IRR, of projects.