Asked by

Moises Chauca

on Oct 15, 2024

Verified

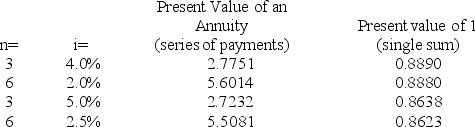

On January 1,a company issues bonds dated January 1 with a par value of $200,000.The bonds mature in 3 years.The contract rate is 4%,and interest is paid semiannually on June 30 and December 31.The market rate is 5%.Using the present value factors below,the issue (selling) price of the bonds is:

A) $205,607.

B) $194,492.

C) $200,000.

D) $22,032.

E) $172,460.

Market Rate

The current price or cost of a good or service in the marketplace, often used in reference to interest rates or wages.

Contract Rate

The agreed-upon price or rate specified in a contract for services or goods, often locked in for the duration of the agreement.

Issue Price

The price at which securities, such as bonds or shares, are originally sold to the public or investors by the issuing entity.

- Understand the concepts of bond issuance and the factors affecting bond pricing.

Verified Answer

LM

Learning Objectives

- Understand the concepts of bond issuance and the factors affecting bond pricing.