Asked by

Sarah Schollmeier

on Oct 10, 2024

Verified

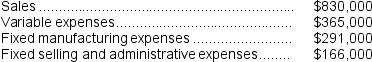

The management of Furrow Corporation is considering dropping product L07E.Data from the company's budget for the upcoming year appear below:  In the company's accounting system all fixed expenses of the company are fully allocated to products.Further investigation has revealed that $186,000 of the fixed manufacturing expenses and $106,000 of the fixed selling and administrative expenses are avoidable if product L07E is discontinued.The financial advantage (disadvantage) for the company of eliminating this product for the upcoming year would be:

In the company's accounting system all fixed expenses of the company are fully allocated to products.Further investigation has revealed that $186,000 of the fixed manufacturing expenses and $106,000 of the fixed selling and administrative expenses are avoidable if product L07E is discontinued.The financial advantage (disadvantage) for the company of eliminating this product for the upcoming year would be:

A) $8,000

B) ($173,000)

C) ($8,000)

D) $173,000

Fixed Manufacturing Expenses

These are the expenses that remain constant regardless of the amount of goods produced, including rent for factory buildings or lease payments for manufacturing equipment.

Fixed Selling

Expenses that remain constant regardless of the level of sales or production, such as salaries of sales managers and rental charges of retail spaces.

Eliminating Product

The process of removing a product from a company's offerings, often due to low sales, obsolescence, or strategic repositioning.

- Investigate the impact on the corporation's aggregate net operating income following the discontinuation of a product or department.

Verified Answer

CJ

Learning Objectives

- Investigate the impact on the corporation's aggregate net operating income following the discontinuation of a product or department.