Asked by

Maranda McLean

on Nov 19, 2024

Verified

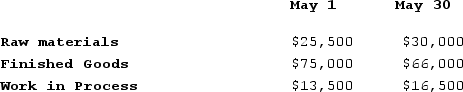

Tyare Corporation had the following inventory balances at the beginning and end of May:  During May, $58,500 in raw materials (all direct materials) were drawn from inventory and used in production. The company's predetermined overhead rate was $12 per direct labor-hour, and it paid its direct labor workers $15 per hour. A total of 300 hours of direct labor time had been expended on the jobs in the beginning Work in Process inventory account. The ending Work in Process inventory account contained $7,050 of direct materials cost. The Corporation incurred $42,000 of actual manufacturing overhead cost during the month and applied $39,600 in manufacturing overhead cost.The actual direct labor-hours worked during May totaled:

During May, $58,500 in raw materials (all direct materials) were drawn from inventory and used in production. The company's predetermined overhead rate was $12 per direct labor-hour, and it paid its direct labor workers $15 per hour. A total of 300 hours of direct labor time had been expended on the jobs in the beginning Work in Process inventory account. The ending Work in Process inventory account contained $7,050 of direct materials cost. The Corporation incurred $42,000 of actual manufacturing overhead cost during the month and applied $39,600 in manufacturing overhead cost.The actual direct labor-hours worked during May totaled:

A) 2,800 hours

B) 3,500 hours

C) 3,300 hours

D) 3,600 hours

Direct Labor-Hours

The cumulative hours that employees actively participating in manufacturing processes have worked.

Predetermined Overhead

An estimated rate used in manufacturing to allocate overhead costs to products or services based on a certain activity measure.

- Calculate actual direct labor-hours worked based on provided data.

Verified Answer

SD

Learning Objectives

- Calculate actual direct labor-hours worked based on provided data.

Related questions

When Actual Overhead Costs Are Not Known Until the End ...

If the Overhead Applied Rate Based on Direct Labor Hours ...

If Direct Labor for the Month Is $105,000, and Overhead ...

Direct Labor for the Month Is $52,000, and Overhead Is ...

Jackson Manufacturing Is Using a Manufacturing Overhead Application Rate of ...